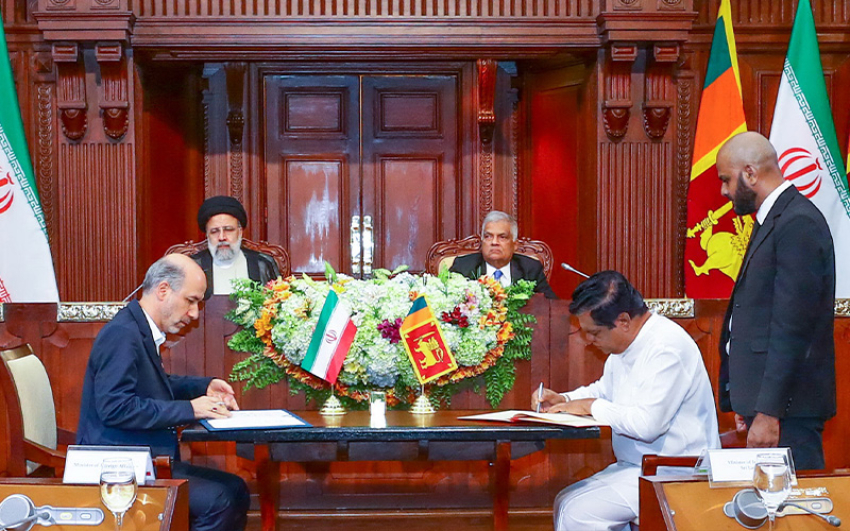

The signing ceremony took place in Beijing at the Great Hall of the People. The AIIB is expected to focus on infrastructure development in Asia, and unlike the existing International Monetary Fund and World Bank, is unlikely to restrict lending on political considerations.

Following the ceremony, China’s President Xi Jinping welcomed the heads of delegations from the Bank’s 57 prospective founding members.

A special ministerial meeting was also held in the afternoon chaired by Chinese Finance Minister Lou Jiwei.

“The AIIB is an example of constructive cooperation among emerging economies to increase the space available for infrastructure financing… It is a regional initiative and, therefore, fully complements global initiatives such as the New Development Bank [set up by the BRICS nations],” former economic diplomat and Director of the National Institute of Public Finance and Policy in New Delhi, Rathin Roy, has told The Hindu.

According to an AIIB press statement, the Bank will be headquartered in Beijing, and will have an initial authorised capital stock of $100 billion. Reflecting regional character of the Bank, its regional members will be the majority shareholders, holding around 75 percent of shares. The AIIB is expected to become operational by the end of the year.

Ashok K Kantha, India’s Ambassador in China, led the Indian delegation at the ceremony and signed the Articles of Agreement.

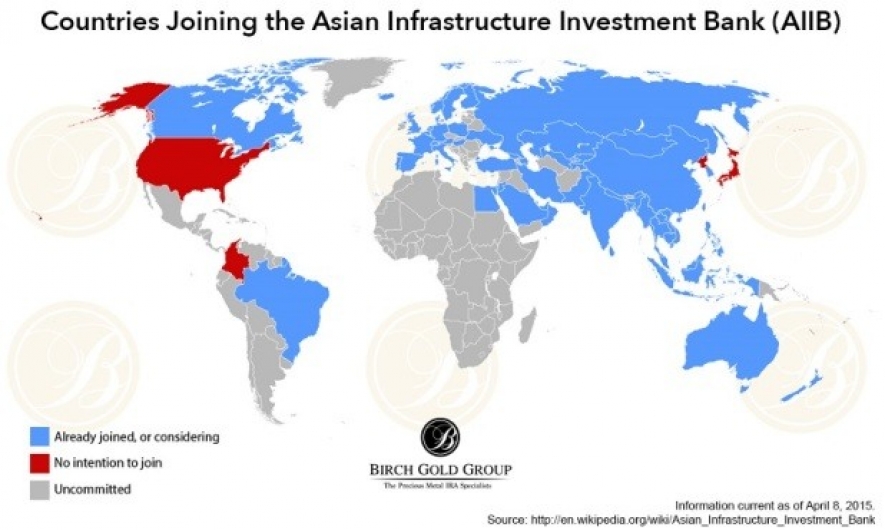

With Japan, the other large Asian economy besides China, opting out of the Bank’s membership, India is its second largest shareholder with a stake of 8.52 per cent and voting share of 7.5 per cent.

The voting shares are based on the size of each member country’s economy and not contribution to the Bank’s authorised capital. China’s shareholding is 30.34 per cent and it has retained 26.06 per cent of the voting rights with veto powers for certain key decisions.

Apart from China and India, some of the countries which signed the agreement include Australia, Bangladesh, Brazil, Cambodia, Finland, France, Germany, Italy, Jordan, Nepal, Netherlands, New Zealand, Norway, Pakistan, Portugal, Republic of Korea, Russia, Saudi Arabia, Singapore, Spain, Sri Lanka, Sweden, Switzerland, and the U.K.